DENVER, October 30, 2025

Third Quarter 2025 Highlights

(Compared to third quarter 2024 unless otherwise noted)

- Total Revenue decreased 6.7% to $73.3 million

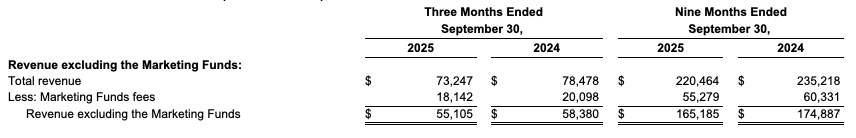

- Revenue excluding the Marketing Funds1 decreased 5.6% to $55.1 million, driven by a negative 5.4% organic revenue growth2 and 0.2% adverse foreign currency movements

- Net income attributable to RE/MAX Holdings, Inc. of $4.0 million and income per diluted share (GAAP EPS) of $0.19

- Adjusted EBITDA3 decreased 5.6% to $25.8 million, Adjusted EBITDA margin3 of 35.2% and Adjusted earnings per diluted share (Adjusted EPS3) of $0.37

- Total agent count increased 1.4% to 147,547 agents

- U.S. and Canada combined agent count decreased 5.1% to 74,198 agents

- Total open Motto Mortgage franchises decreased 10.3% to 210 offices4

RE/MAX Holdings, Inc. (the “Company” or “RE/MAX Holdings”) (NYSE: RMAX), parent company of REMAX, one of the world’s leading franchisors of real estate brokerage services, and Motto Mortgage (“Motto”), the first and only national mortgage brokerage franchise brand in the U.S., today announced operating results for the quarter ended September 30, 2025.

“Our total REMAX agent count reached another all-time high this quarter, fueled by steady global growth and the strongest third-quarter U.S. agent count results we’ve had in three years. Based on feedback from the membership, we believe our mix of new ideas, new products and new systems is enhancing our value proposition and generating great energy within the network. At the same time, our constant focus on operational excellence is driving profitability and margin performance exceeding expectations,” said Erik Carlson, Chief Executive Officer of RE/MAX Holdings.

Continued Carlson: “In both the REMAX and Motto Mortgage networks, we’re leaning heavily into innovation to deliver an elevated experience to affiliates and the consumers they serve. Many of our new offerings, like the recently launched AI-powered REMAX Marketing as a Service (“MaaS”) platform, leverage the strength of our scale to create new competitive advantages. We also introduced two more optional economic models for REMAX – Appreciate and Ascend – that build on the success of Aspire and give U.S. franchisees even more flexibility in recruiting and retaining productive professionals. Lastly, we’ve rounded out our executive leadership team with two highly respected industry veterans: Vic Lombardo, President of Mortgage Services, and Tom Flanagan, Chief Digital Information Officer. Both are already contributing fresh strategies to help affiliates win more business, save time and become more profitable.”

Third Quarter 2025 Operating Results

Agent Count

The following table compares agent count as of September 30, 2025 and 2024:

Revenue

RE/MAX Holdings generated revenue of $73.3 million in the third quarter of 2025, a decrease of $5.2 million, or 6.7%, compared to $78.5 million in the third quarter of 2024. Revenue excluding the Marketing Funds was $55.1 million in the third quarter of 2025, a decrease of $3.3 million, or 5.6%, versus the same period in 2024. The decrease in Revenue excluding the Marketing Funds was attributable to a decline in organic revenue of 5.4% and adverse foreign currency movements of 0.2%. The decline in organic revenue was driven by a decrease in U.S. agent count, and, to a lesser extent, incentives related to recently introduced modifications to the Company’s standard fee models, including the Aspire program, partially offset by an increase in revenue from advertising revenue on the Company’s flagship websites.

Recurring revenue streams, which consist of continuing franchise fees and annual dues, decreased $3.7 million, or 9.6%, compared to the third quarter of 2024 and accounted for 63.6% of Revenue excluding the Marketing Funds in the third quarter of 2025 compared to 66.4% in the prior-year period.

Operating Expenses

Total operating expenses were $54.9 million for the third quarter of 2025, a decrease of $8.3 million, or 13.2%, compared to $63.3 million in the third quarter of 2024. Third quarter 2025 total operating expenses decreased primarily due to lower Selling, operating, and administrative expenses, Settlement and impairment charges, Marketing Funds, and Depreciation and amortization expenses.

Selling, operating and administrative expenses were $32.5 million in the third quarter of 2025, a decrease of $3.5 million, or 9.7%, compared to the third quarter of 2024 and represented 58.9% of Revenue excluding the Marketing Funds, compared to 61.5% in the prior-year period. Third quarter 2025 Selling, operating and administrative expenses decreased primarily due to certain lower personnel expenses and a reduction in other events, partially due to their timing, offset by higher investments in technology and our flagship websites, and an increase in bad debt, legal expenses and the estimated fair value of the contingent consideration liability.

Net Income and GAAP EPS

Net income attributable to RE/MAX Holdings was $4.0 million for the third quarter of 2025 compared to net income of $1.0 million for the third quarter of 2024. Reported basic and diluted GAAP earnings per share were $0.20 and $0.19, respectively for the third quarter of 2025 compared to basic and diluted GAAP earnings per share of $0.05 each in the third quarter of 2024.

Adjusted EBITDA and Adjusted EPS

Adjusted EBITDA was $25.8 million for the third quarter of 2025, a decrease of $1.5 million, or 5.6%, compared to the third quarter of 2024. Third quarter 2025 Adjusted EBITDA decreased primarily due to lower revenue from the declines in U.S. agent count, a decline in revenue as a result of recently implemented changes to the Company’s existing fee models, including the Aspire program, increases in expenses related to higher investments in technology and our flagship websites, and an increase in bad debt and legal expenses, offset by certain lower personnel-related expenses and increased advertising revenue on our flagship websites. Adjusted EBITDA margin was 35.2% in the third quarter of 2025, compared to 34.8% in the third quarter of 2024.

Adjusted basic and diluted EPS were $0.38 and $0.37 respectively for the third quarter of 2025 compared to Adjusted basic and diluted EPS of $0.39 and $0.38, respectively for the third quarter of 2024. The ownership structure used to calculate Adjusted basic and diluted EPS for the quarter ended September 30, 2025, assumes RE/MAX Holdings owned 100% of RMCO, LLC (“RMCO”). The weighted average ownership RE/MAX Holdings had in RMCO was 61.5% for the quarter ended September 30, 2025.

Balance Sheet

As of September 30, 2025, the Company had cash and cash equivalents of $107.5 million, an increase of $10.9 million from December 31, 2024. As of September 30, 2025, the Company had $437.9 million of outstanding debt, net of an unamortized debt discount and issuance costs, compared to $440.8 million as of December 31, 2024.

Share Repurchases and Retirement

As previously disclosed, in January 2022 the Company’s Board of Directors authorized a common stock repurchase program of up to $100 million. During the three months ending September 30, 2025, the Company did not repurchase any shares. As of September 30, 2025, $62.5 million remained available under the share repurchase program.

Outlook

The Company’s third quarter and full year 2025 Outlook assumes no further currency movements, acquisitions, or divestitures.

For the fourth quarter of 2025, RE/MAX Holdings expects:

- Agent count to increase 0.0% to 1.5% over fourth quarter 2024;

- Revenue in a range of $69.5 million to $73.5 million (including revenue from the Marketing Funds in a range of $17.0 million to $19.0 million); and

- Adjusted EBITDA in a range of $19.0 million to $23.0 million.

For the full year 2025, the Company now expects:

- Agent count in a range from 0.0% to positive 1.5% over full year 2024

- Revenue in a range of $290.0 million to $294.0 million (including revenue from the Marketing Funds in a range of $72.0 million to $74.0 million), a change from $290.0 million to $296.0 million (including revenue from the Marketing Funds in a range of $72.0 million to $74.0 million); and

- Adjusted EBITDA in a range of $90.0 million to $94.0 million, a change from $90.0 million to $95.0 million.

Webcast and Conference Call

The Company will host a conference call for interested parties on Friday, October 31, 2025, beginning at 8:30 a.m. Eastern Time. Interested parties can register in advance for the conference call using the link below:

https://registrations.events/direct/Q4I9411539

Interested parties also can access a live webcast through the Investor Relations section of the Company’s website at http://investors.remaxholdings.com. Please dial in or join the webcast 10 minutes before the start of the conference call. An archive of the webcast will be available on the Company’s website for a limited time as well.

Basis of Presentation

Unless otherwise noted, the results presented in this press release are consolidated and exclude adjustments attributable to the non-controlling interest.

Footnotes:

1Revenue excluding the Marketing Funds is a non-GAAP measure of financial performance that differs from U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) and a reconciliation to the most directly comparable U.S. GAAP measure is as follows (in thousands):

2The Company defines organic revenue growth as revenue growth from continuing operations excluding (i) revenue from Marketing Funds, (ii) revenue from acquisitions, and (iii) the impact of foreign currency movements. The Company defines revenue from acquisitions as the revenue generated from the date of an acquisition to its second anniversary (excluding Marketing Funds revenue related to acquisitions where applicable).

3Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EPS are non-GAAP measures. These terms are defined at the end of this release. Please see Tables 5 and 6 appearing later in this release for reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

4Total open Motto Mortgage franchises includes only “bricks and mortar” offices with a unique physical address with rights granted by a full franchise agreement with Motto Franchising, LLC and excludes any “virtual” offices or BranchiseSM offices.

# # #

About RE/MAX Holdings, Inc.

RE/MAX Holdings, Inc. (NYSE: RMAX) is one of the world’s leading franchisors in the real estate industry, franchising real estate brokerages globally under the REMAX® brand, and mortgage brokerages within the U.S. under the Motto® Mortgage brand. REMAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. Now with more than 145,000 agents in nearly 9,000 offices and a presence in more than 110 countries and territories, nobody in the world sells more real estate than REMAX, as measured by total residential transaction sides. Dedicated to innovation and change in the real estate industry, RE/MAX Holdings launched Motto Franchising, LLC, a ground-breaking mortgage brokerage franchisor, in 2016. Motto Mortgage, the first and only national mortgage brokerage franchise brand in the U.S., has offices across more than 40 states.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project,” “anticipate,” “may,” “will,” “would” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. Forward-looking statements include statements related to agent count; Motto open offices; franchise sales; revenue; the Company’s outlook for the fourth quarter and full year 2025; non-GAAP financial measures; housing and mortgage market conditions; the Company’s commitment to innovation and delivering an elevated experience; enhancing our value proposition; our profitability and margin performance exceeding expectations; our new MaaS platform and economic models and the impact thereof; and our strengthened leadership team. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily accurately indicate the times at which such performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include, without limitation, (1) changes in the real estate market or interest rates and availability of financing, (2) changes in business and economic activity in general, including enacted and proposed tariffs and other trade policies which could impact the global economy, (3) the Company’s ability to attract and retain quality franchisees, (4) the Company’s franchisees’ ability to recruit and retain real estate agents and mortgage loan originators, (5) changes in laws and regulations, (6) the Company’s ability to enhance, market, and protect its brands, (7) the Company’s ability to implement its technology initiatives, (8) risks related to recent changes in the Company’s leadership team, (9) fluctuations in foreign currency exchange rates, (10) the nature and amount of the exclusion of charges in future periods when determining Adjusted EBITDA is subject to uncertainty and may not be similar to such charges in prior periods, and (11) those risks and uncertainties described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company’s website at www.remaxholdings.com and on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no obligation, to update this information to reflect future events or circumstances.

Investor Contact:

Joe Schwartz

(303) 796.3693

joe.schwartz@remax.com

Media Contact:

Kimberly Golladay

(303) 224.4258

kgolladay@remax.com

To access appendix tables and Non-GAAP Financial Measures, download a PDF of the press release via the Media Tray.