2022 saw significant market changes, impacting the affordability and accessibility of housing across the U.S. The post-pandemic environment, complete with drastic lifestyle changes, continued to spur relocation for a myriad of reasons, particularly the cost of living. The Asian American and Native Hawaiian/Pacific Islander (AANHPI) community – a significant portion of the U.S. population and 11% of the population in the West alone – continues to make strides in homeownership.

This is evident in the 2023 State of Asia report by the Asian Real Estate Association of America (AREAA), an organization that strives to create accessible homeownership opportunities in communities and through policy change for Asian Americans. RE/MAX, a proud partner of AREAA, co-sponsors the annual report, which unpacks the current state of housing for AANHPI individuals and identifies ways real estate professionals can support fair housing.

“This report is easily the most comprehensive compilation of Asian American and Pacific Islander real estate, demographic and economic data available today. It’s a crucial resource for any professional who serves the [AANHPI] community,” Abby Lee, RE/MAX Senior Vice President of Marketing and Communications, said in the report’s foreword.

“Dive into the report’s insights, put them to use and share them with others. In the 2023 market, buyers and sellers need every advantage they can get. A smarter, prepared real estate agent is one of the biggest of all.”

Here’s an overview of key findings in the 2023 State of Asia Report.

2023 State of Asia Report

AANHPI homeownership stats and needs vary by origin

The 2023 report uniquely breaks down homeownership intel for each of the dozen communities under the AANHPI umbrella.

“While there have been wins [when it comes to data disaggregation], the fact remains that data on AANHPIs is frequently only reported as an aggregate. This obscures critical information on healthcare, homeownership rates, income, and more,” the report says. “While it is true that organizations like AREAA represent and advocate for all different subgroups, we simultaneously recognize that these communities are vastly different.

Subsets of the AANHPI have differing concerns in today’s economy, which can translate to the homebuying and selling processes. For example, when voting, the leading issues of importance for the Filipino American population, which accounts for nearly 3 million people nationwide, are inflation and jobs/the economy, while the leading issues of importance for the Chinese American population, which accounts for over 4 million people nationwide, is racism and racial discrimination.

These two examples alone can point to real estate consumers seeking increasingly affordable options in the market, while also prioritizing working with professionals who uphold fair housing practices and serve the needs of the AANHPI community.

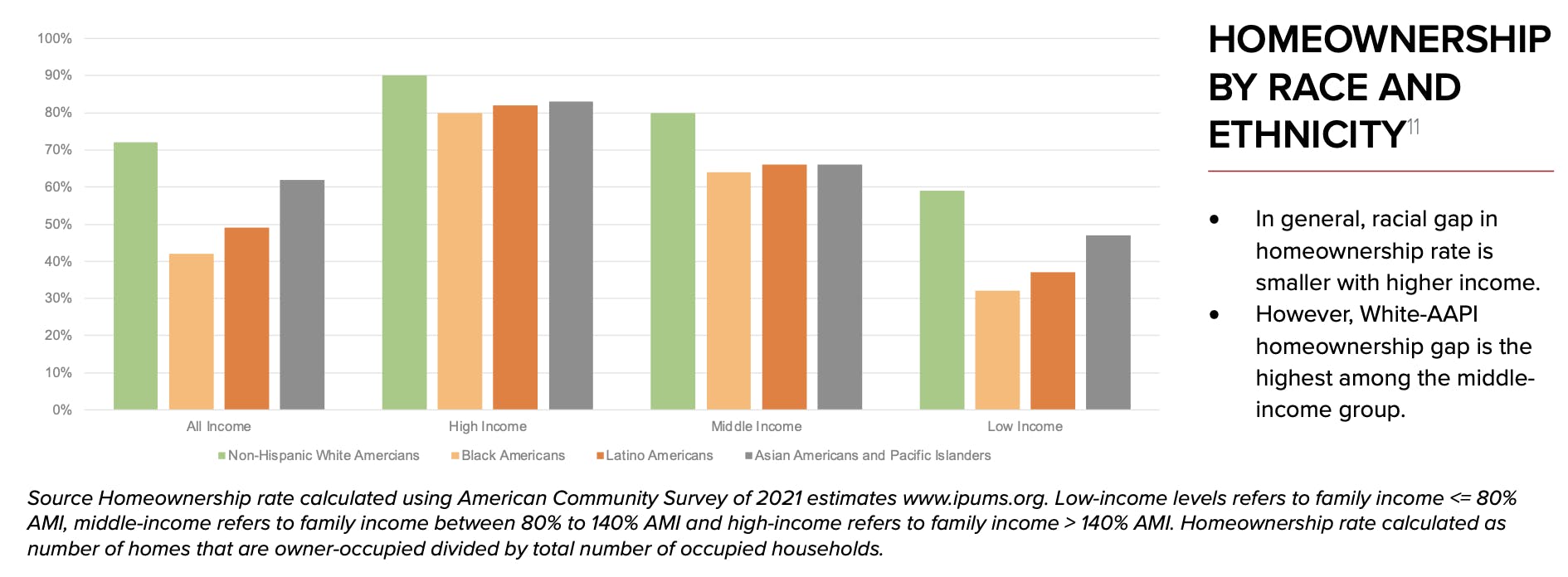

Though different racial demographics present varying rates of homeownership in the U.S., the AANHPI community as a whole is still falling short of the homeownership rates of Non-Hispanic White Americans.

image-20240102-034052

The distinct breakdown of data helps identify overarching patterns in living and housing.

“First, while it is true that the overall homeownership rate is higher than Black Americans and Latino Americans, it is still lagging noticeably behind that of White Americans,” the report shares. “Second, close inspection indicates a lagging middle income bracket in the AAPI community. This disparity is important because it indicates significant opportunity for expansion within the middle-income bracket for AAPIs and shows where there still is need for assistance.”

Affordability depends on region

Over the past few years, the entire country has faced some variation of a bustling seller’s market, as well as general economic inflation. However, some locales – particularly the West and Northeast – are seeing a greater divide in the affordability gap.

The West Coast contains many higher-income hubs, like Silicon Valley and San Francisco, and consequently sees high home prices across the board. The report shows how the West region happens to be home to a higher concentration of the AANHPI population – more than 8.7 million people – placing a significant portion of the community in widely unaffordable local real estate markets.

That said, for multiple reasons – especially those based on international proximity – the West continues to be a popular location for Asian Americans to reside. As of 2021, according to the report, Washington had seen a positive net migration of nearly 25,000 AAPI individuals.

And while the Asian American rate of homeownership in the West is closely aligned with the overarching rate throughout the region – 61.3% – the Native Hawaiian and Other Pacific Islander (NHOPI) community in the same area has a homeownership rate of only 43.7%.

Conversely, the Midwest – a region with the highest rates of affordability in the U.S. – has a smaller gap between NHOPI homeownership rates compared to that of the population as a whole. And while the Midwest isn’t seeing the same influx of AAPI individuals like the West, it is seeing growth – Kansas, Ohio, and other nearby states have seen a substantial positive net migration as of 2021.

From coast to coast and everywhere in between, homeownership remains a goal for many among the AANHPI community, and AREAA is supporting real estate professionals and consumers alike – especially with this critical information broken down by location and origin.

To learn more about the state of housing for the AANHPI community and the role AREAA plays in advocating for sustainable homeownership, download the full 2023 State of Asia report.

Recommended For You

Market Trends| Home Prices Are Moderating, RE/MAX Reports

Get RE/MAX News delivered to your inbox! Sign up for News Alerts in the footer below.