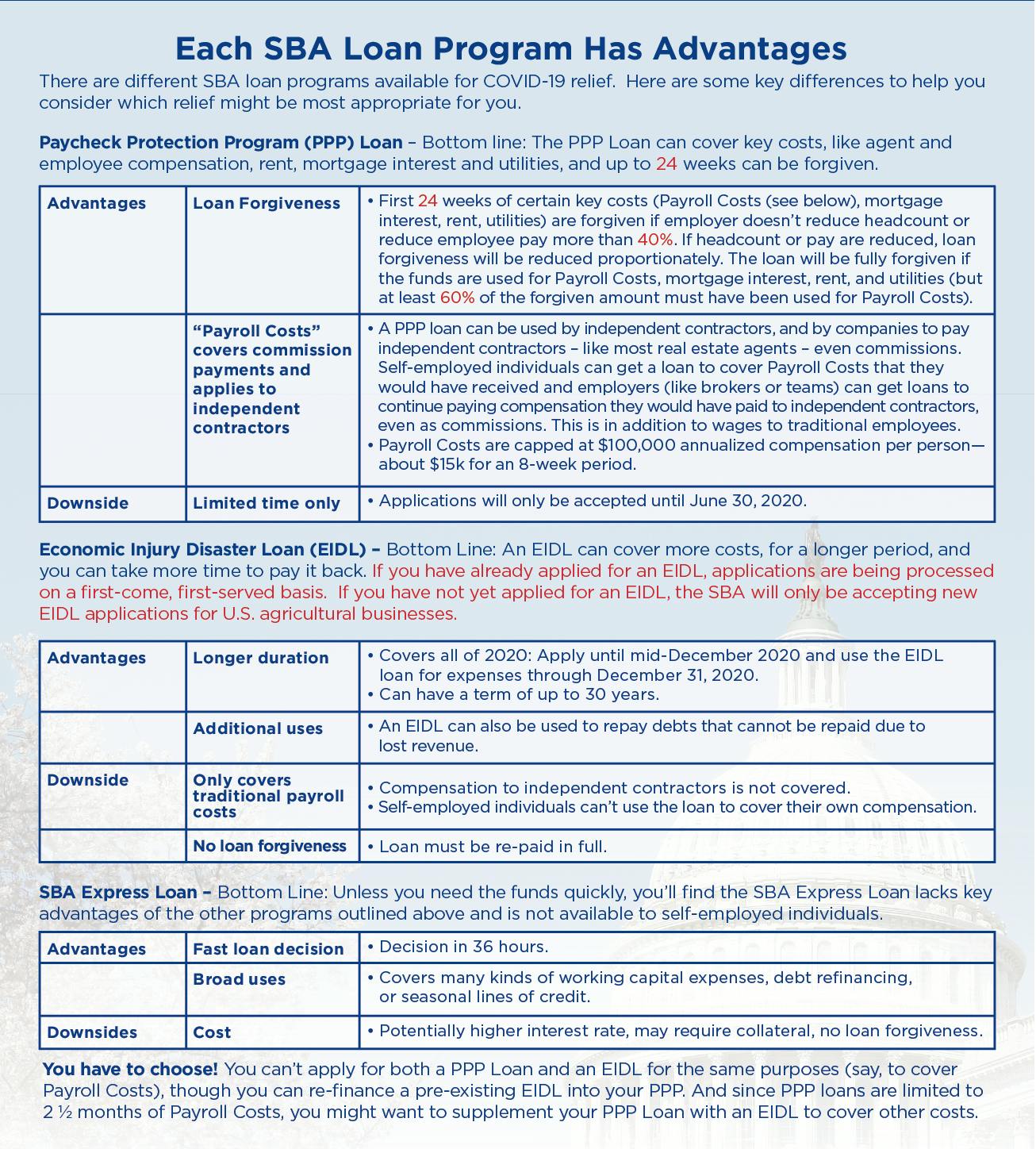

RE/MAX continues to monitor the Paycheck Protection Program and Health Care Enhancement Act (H.R. 266), which will provide additional funding for small businesses, including for PPP loans and SBA Economic Injury Disaster Loans and Grants.

· If you’ve already applied for an EIDL: The SBA is processing applications already in their system on a first-come, first-served basis.

· If you have not already applied for an EIDL: Going forward, the SBA will only be accepting new EIDL applications for U.S. agricultural businesses.

· If you’ve been granted a PPP loan: The SBA is now accepting applications for loan forgiveness if you are eligible. See resources below regarding eligibility.

· If you have not applied yet for a PPP loan through an SBA lender: Have the application form filled out and your documentation ready to provide to your lender. (For brokers with employees, have payroll documentation; for sales associates, have your 2019 Form 1040, Schedule C, and 1099-MISC.) If you have an existing relationship with an SBA lender, you should go to that lender first, or you can find a lender on the SBA site.

For additional information on these programs and other helpful resources scroll down.

image-20240102-034052

From NAR:

Coronavirus: A Guide For REALTORS®

Coronavirus: SBA CARES Act FAQs

Coronavirus Guidance: Commercial Real Estate

Coronavirus: Mortgage and Personal Finance FAQs

Coronavirus: Unemployment Assistance CARES Act FAQs

Coronavirus Aid, Relief, and Economic Security Act

Coronavirus Emergency Legislation: What REALTORS Need to Know

Coronavirus Aid, Relief, and Economic Security Act: Provisions for REALTORS and Their Consumers

Additional Resources:

State Chamber of Commerce and Real Estate Association COVID-19 Resources

Economic Injury Disaster Loan (EIDL) Application Deadlines by State

U.S. Department of the Treasury CARES Act Information

SBA Form 2462 Addendum to Franchise Agreement

SBA PPP Guidelines – 4.24.20 – How to Calculate Loan Amount

Important: This summary is for your information only and cannot provide every detail that might be relevant to your situation. RE/MAX, LLC cannot be responsible for errors or omissions and cannot provide legal or tax advice. Research your options carefully.